With the MindNation CareNow Plan©, team members have access to 24/7 teletherapy sessions with psychologists and WellBeing Coaches whenever they are feeling stressed and anxious. Visit www.mindnation.com to learn more.

Are you asking your team to report back to their offices? While some employees are excited to go back to the office, others are struggling with varying degrees of anxiety. They may be reluctant to leave their family after being in close proximity with them for more than two years, afraid of leaving the safety of home and catching the COVID-19 virus, or anxious over adjusting to a new work schedule and routine.

If you are tasked with nudging people to return to work, business coach and consultant Grace De Castro of V+A Consulting, a boutique consulting firm with expertise in customized people programs and creative business solutions, shares some things you can do to ease their anxieties and make the transition easier:

- Ensure workplace safety. The first and most important thing to do is conduct a review of the physical space to make sure it follows minimum public health standards and safety protocols. Is it well-ventilated? Can social distancing be followed? What is the procedure if someone comes to work with symptoms? And if your employees do get sick with COVID-19, is treatment covered by their medical insurance and how much time will they be given to recover? Then, once these are in place, proceed to #2.

- Personally communicate these to your team. “Don’t just hand out memos or shoot out an email,” Grace advises. “Instead, hold a virtual meeting to inform staff about everything that the company is doing to make the site physically safe, and even what the expectations are in terms of schedule and responsibilities.” By adding this personal touch, employees will feel more assured and less anxious.

- Bring them back slowly. Having your employees come back all at once will only cause confusion and increase anxiety. Instead, schedule their return in batches to give them the time and space to adjust to the physical workplace and new procedures. Then, once everyone is settled in, don’t forget to do #4.

- Hold frequent one-on-ones or team meetings. “The purpose of these check-ins are two-fold,” says Grace. “The first is to enable those who are anxious and struggling to feel that they are being heard and validated. The second is for you to communicate and reiterate the company’s vision, expectations, and business direction.” This ensures that the entire team is on the same page, and roles and responsibilities are made clear.

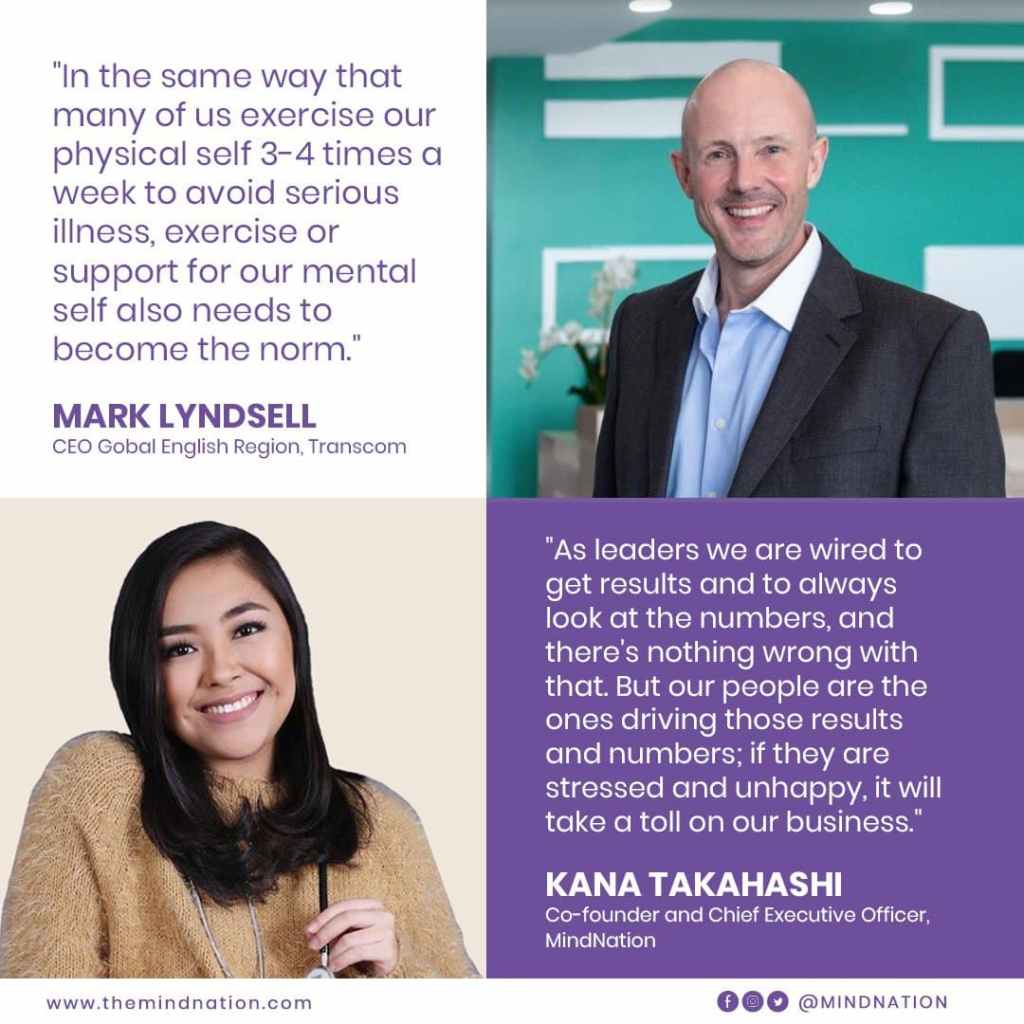

- Show them that you are also taking care of yourself. “As a leader, you are probably putting up a brave face and hiding your own fears and anxieties,” Grace points out. “But shielding your emotions will only make your employees feel as if they are the only ones with problems and more alone.” So if you are feeling anxious or stressed, for example, let your team see you taking a mental health break or advise them that you will be talking to a mental health professional. “This will make them see you as human and will further normalize the conversation about mental health and well-being in the workplace,” she adds.

“If you are feeling anxious or stressed, for example, let your team see you taking a mental health break or advise them that you will be talking to a mental health professional.”

Grace De Castro, Business Coach And Consultant

As a manager, it’s important to remember that your team members may be going through something related to the pandemic that you are not aware of. Asking them to return to work should be accompanied with compassion and open conversation.